Keeping Your Head in the Game

by John D. Kirkgard

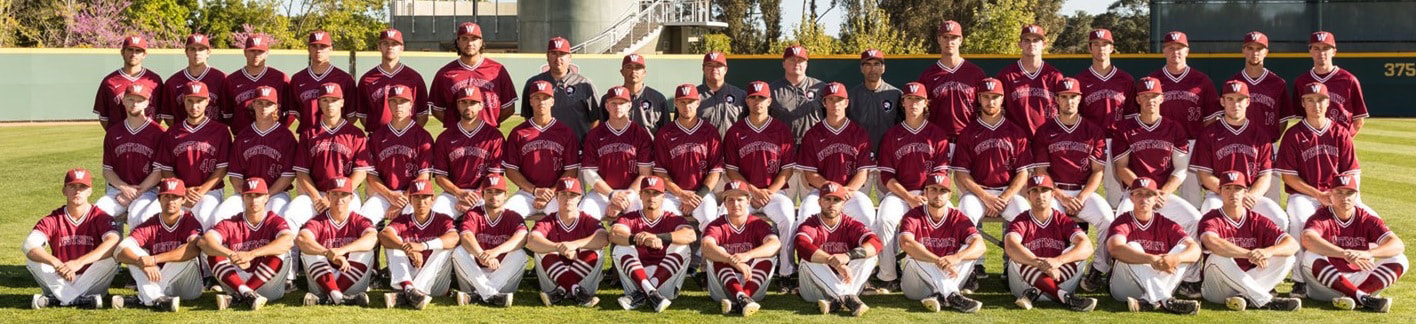

Registered Investment Advisor As many of you know, I spent many years training and developing young baseball players at every level of the game. As a coach at Westmont College and at UCSB, I saw that the standout players—many of whom have gone on to successful major league careers—all shared one specific character trait: discipline. At the collegiate level, every player has the gifts to play the game at a high level: speed, agility, strength, hand-eye coordination. But those who see the greatest progress, reach their goals, and fulfill their baseball dreams never doubt their course of action and never pull up short. I’ve often seen lesser talents achieve great success simply because they possess greater discipline and remain focused on their objectives. The same is true with investors.

Merely “hoping” to achieve financial goals is not enough. Portfolios grow and achieve great success for their owners only when things are managed with patience and discipline. There is little argument that today’s investment markets hold the potential for significant gains over time. Over time.

The greatest threat to any investment plan is often the investor him/herself. Impatience and an inability to stay the course with consistent effort can cost an investor with even the greatest resources far more than poor tax planning. Current research points to the fact that today’s average mutual fund investor fails to remain invested for a long enough time period to enjoy true portfolio growth. They simply fall short of the returns and appreciation enjoyed by more disciplined investors. In my experience, it’s the individual investor—working without benefit of a trusted financial advisor—who usually acts impatiently and inconsistently and then wonders where things went wrong. Imagine what happens to a base runner who ignores the signs from his coach; he often gets tagged out. The sad truth is that managing one’s own investment portfolio is easily compared to the defendant who eschews lawyers and represents himself in court. The defendant is famously “a fool” and the do-it-yourself investor is often “headed for the drain.” It’s true that today’s markets have shown impressive gains. Given that, it remains a dynamic environment where things can change quickly and the individual investor can be caught as flat-footed as an outfielder who takes his eye off the ball. The only way to survive the inherent volatility of the marketplace is with a long term perspective built on discipline and patience. Just as a baseball player performs best with the moment-to-moment guidance of his coaches, the successful investor works with a trusted, experienced advisor to help him keep his eye on the ball and his head in the game. I’m happy to discuss your individual financial goals, your retirement planning, or ways to improve your portfolio performance. We can even talk baseball! Just give me a call at (805) 570-1590.

Socially Responsible Investing:

|

Socially Responsible Investing: At the Core